As a private landlord, it’s important to stay organised when it comes to your finances. One way to simplify your accounts payable process is to go paperless. This is a great way to save time and keep track of expenses. That said, let’s explore seven of the best financial planning tips for private landlords to help make the transition to paperless accounts payable.

Get your affairs in order

The first step in successful financial planning for private landlords is to get your affairs in order. This means having a clear understanding of all of your income sources and expenses. You should also make sure you have the necessary insurance, certificates and licenses for operating as a landlord. It’s also important to keep accurate records of all transactions and maintain up-to-date business records.

To help with this, it’s best to invest in a decent accounting software. There are many apps available for small businesses, such as QuickBooks, Xero and FreshBooks. These programs make it easy to record income and expenses, create invoices and reports, and manage your accounts receivable. They also provide helpful features such as automatic bank feeds, so you can quickly access and update your financial information. Investing in accounting software can help you stay organised and in control of your finances.

Create a budget

Creating a budget is essential for landlords to ensure that they are making sound financial decisions. Having a budget helps you to determine how much money you have to spend on repairs and other expenses and how much you can afford to spend. The best apps for small businesses make it easier than ever to create and manage a budget.

You can quickly manage your income and expenses with budgeting tools, keep an eye on your cash flow and set savings targets. Additionally, a lot of these applications offer helpful graphs and reports that you can use to view your financial data and make quick adjustments to your budget as necessary. Many of these budget planning apps also provide recommendations and guidance to assist landlords increase their revenues. Making a budget can help landlords ensure that they are always in the black and to not overspend if the proper tools are in place.

Invest in good accounting software

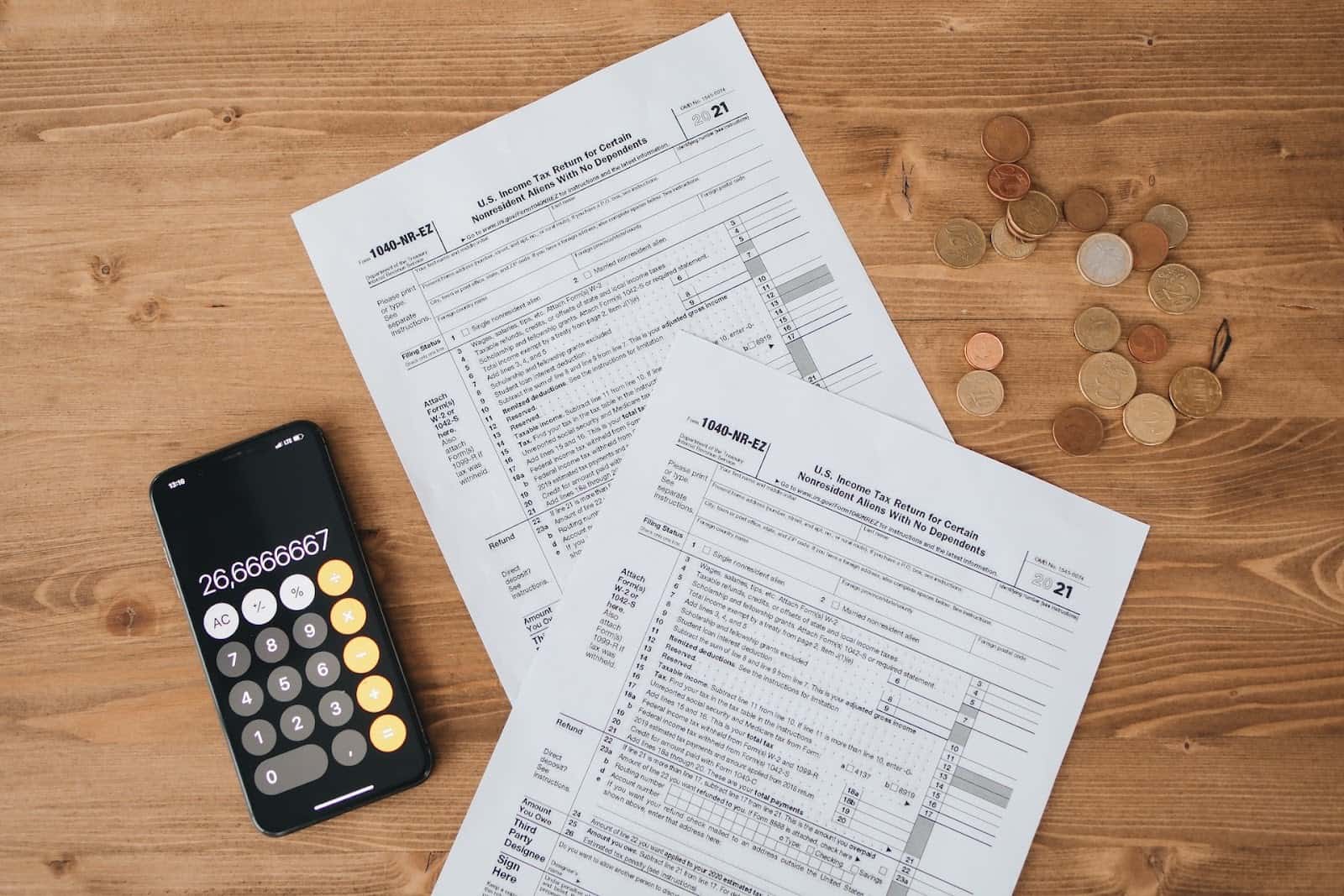

Having the right accounting software can make a huge difference in the success of your rental business. The best software for small businesses allow you to manage accounts receivable and accounts payable, track expenses and income, and file taxes with ease.

When choosing accounting software, look for one that offers features tailored to your needs. If you’re a landlord, you’ll likely want features such as tenant payments, tenant profiles, maintenance tracking and reporting capabilities. Be sure to compare different options before settling on the best one for your business.

Using accounting software can save you time, energy and money in the long run. Not only will you be able to keep better track of your finances, but you can also switch to a paperless system. Plus, having everything in one place makes it easier to audit your records whenever necessary.

Stay on top of your invoices

If you’re a private landlord, it is crucial to keep track of all your payments. This means staying on top of any invoices that have been sent and any payments that have been received. Having appropriate account software allows you to set up automated payment reminders so you never miss an invoice.

Keep your receipts organised

Organising receipts is one of the most important financial planning tips for private landlords. Receipts provide evidence of the money you’ve spent in order to run your rental business, so it’s important to keep them in a safe place.

If you don’t want to use paper and a filing system, there are plenty of tools out there that are specifically designed to help landlords keep their receipts organised. They are often referred to as “expense tracking” apps, and they make it easier to store, organise and track all of your expenses. Choose those that are easy to use, secure and compatible with your accounting software. Some popular examples include QuickBooks Self-Employed, Zoho Expense and Expensify.

Use direct deposit

Direct deposit is an essential tool for private landlords. It’s an efficient and secure way to receive rental payments from tenants. By setting up direct deposit, you can automate your rental income and ensure that your rent is deposited directly into your bank account on time.

To make sure you get the most out of direct deposit, consider using one of the banks that will allow you to set up automatic payment reminders and will alert you if there are any issues with a payment. They also provide detailed reporting and can be linked to other services such as accounting software. This makes it easy to keep track of your rental income and expenses.

Go paperless

One of the best ways to save time and money for private landlords is to go paperless. By implementing a paperless system, you can reduce or eliminate costs associated with mailing invoices and payments, storage fees and manual paperwork processing.

The good news is that there are plenty of apps available to help you do this. Choose the ones that offer features such as easy invoice tracking and payment reminders, automated payment systems, mobile access and cloud-based data storage.

Not only will these tools save you time and money, but they can also help you keep better track of your finances. Instead of having to manually enter every single payment or invoice, these can automate the process for you and provide real-time updates on your accounts receivable.

Takeaway

Good financial planning is essential for private landlords to ensure their business runs smoothly. There are several important tips that can help you manage your finances, such as creating a budget, investing in good accounting software, staying on top of invoices and using direct deposit. Additionally, going paperless with accounts payable can save you a lot of time and effort.

Fortunately, there are several tools for small businesses that can help streamline your accounts payable process. By choosing the right app, you can manage your finances more effectively, making sure your business remains profitable and secure.