The housing market has seen an unprecedented change over the past couple of years, but certain indicators now seem to be pointing towards a return to more traditional levels of activity.

Rental return

A look at average rents makes this point clearly, with rental growth returning to the market after a period of weakening during 2020. Perhaps the most pronounced example of this trend is the return of growth in urban centres, as city centre rental demand returns driving up demand and rental values. The average rent for 1 & 2 bed apartments in the core urban areas of Edinburgh is now over £1,100pcm, up from under £1,000pcm at the start of 2021, with the strongest growth concentrated in central locations and popular urban rental neighbourhoods.

While demand in the sales market has been well covered in the press, the rental market had a more complicated experience over the past two years. This was especially true in urban markets where economic migration, tourism and student populations, which make up a significant component of rental sector activity, were effectively put on hold. While supply in the sales market dipped, then rebounded above pre-pandemic levels, in the rental sector stock levels have remained below pre-pandemic levels.

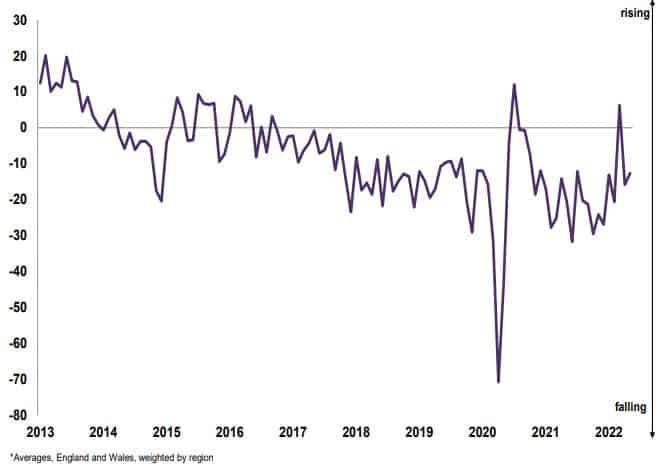

This suppressed level of stock comes after a number of changes in the sector in recent years which has led to a downward trend in supply. Against this backdrop, the pandemic has combined with the forthcoming regulation of the short-let sector and a buoyant sales market to motivate some landlords to take the opportunity to leave the PRS. However, both Scottish listings and RICS national survey results points to an upturn in new landlord instructions in recent months.

New landlord instructions over the past 3 months

Monthly Series Net Balance % NSA

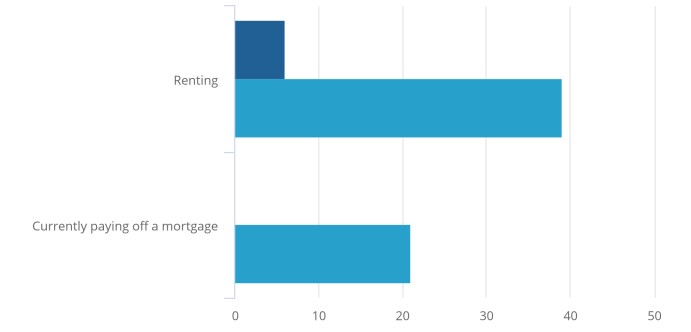

While this may be a positive green shoot, there can be no doubt that inflation and the cost-of-living crisis are going to reduce households’ rental affordability. The most recent ONS Opinions & Lifestyle Survey shows than renters are more likely to have difficulty paying their housing costs than mortgagors and this has obvious implications for both landlords and tenants.

Renters are more likely than mortgagors to report difficulty in paying housing costs

Adults currently paying off a mortgage and/or loan, or rent, or shared ownership in GB 16 to 27 March 2022

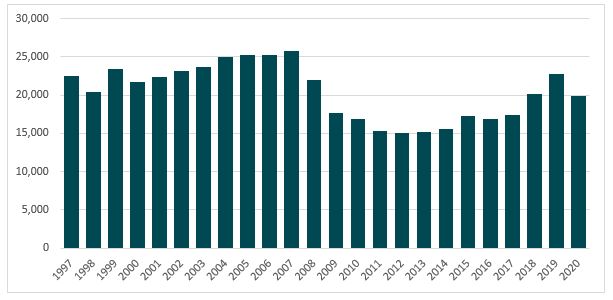

The supply side of the market also has potential potholes down the road. Homes for Scotland’s recent report on The Social & Economic Benefits of Home Building in Scotland highlighted a 100,000 homes shortage across Scotland. The report calls for a 25,000 units per year completion rate across all tenures, based on pre-pandemic figures from the past 14 years. To meet this shortfall in housing need, housing completions would need to increase to a level only seen in the run up to the GFC, and 5,000 units above their 20-year average.

Over the past 20 years housing completions in Scotland have averaged around 20,000 per annum, excluding delivery post pandemic.

All Tenure Housing Completions in Scotland 1997 to 2020

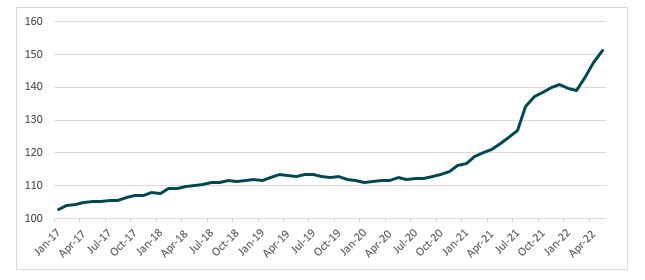

To rise to this challenge, Build To Rent (BTR) at scale will be a critical component in new housing delivery if we are to overcoming the shortfall of supply across all tenures. However, while it may be seen that the housebuilding sector has benefitted from rising sales and rental values in recent times, current labour and material shortages, and rising costs, have been fast eroding development margins and moving forward will potentially impact site viability.

If you consider that the UK Construction Material Price Index for New Homes has jumped from 112 in May 2020 to 151 in May 2022, then the challenge for the sector is clear. Add to this that many councils are now prioritising brownfield first development strategies, which whilst admirable, often has higher complexity and associated costs. If current trends continue, then striving to meet these housing demand figures may prove increasingly challenging in the economic environment in which the sector operates. This has implications for the BTR sector and the wider PRS if we are to bridge the gap between rental demand and a receding supply from small scale private landlords.

The UK’s cost of construction has risen sharply since the pandemic

Construction Material Price Indices – New Homes

Looking ahead it certainly appears that by many measures the market is returning to a more typical base level of activity after an extraordinary period of activity and change. In the PRS, the return of students, labour mobility and tourism, are restoring some form of normality to the sector, although supply and the delivery of new rental stock, for both single family and multifamily, will be a key issue moving forward.

While there is understandable caution creeping into some commentary – due to current geopolitics, supply chain issues, inflation and the cost-of-living crisis – sentiment amongst both buyers and tenants remains robust. For many households, the daily necessities of life trump macro level uncertainties, especially as uncertainty seems to have been a consistent component of the market since the global financial crisis and through bailouts, IndyRef, Brexit and most recently, a global pandemic.