The Scottish rental sector continues to experience a series of changes that started with the introduction of the Additional Dwelling Supplement and the Scottish Private Rental Tenancy (SPRT) in 2016 and 2017, and has seen subsequent changes to tax relief, the introduction of rent control legislation, and the rise of institutional investment in the BTR sector in Scotland. Add to this a pandemic and the PRS in Scotland is a changed, and changing sector.

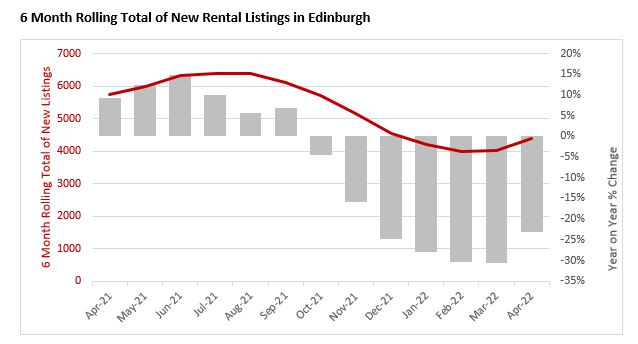

The cumulative impact of these changes, combined with challenges during the pandemic, and a strong sales market, has led many small-scale landlords and investors to reconsider their position in the sector. Over the past couple of years stock levels in the rental sector in Scotland have been consistently falling. New listings coming to the market on the major portals so far in 2022, are around 20% down on the same time last year.

Changes, challenges and year on year growth continue

As the pandemic impacted the market, there was a concern for the desirability of urban living. It was feared that working from home would enable many employees to eschew the high rents and competition of urban centre for suburban and rural lifestyle living. Whilst this may be the case for some, reports of the demise of urban renting and city centre living may have been greatly exaggerated. The combination of strong returning demand in the cities, and limited supply, has seen average rents in Scotland’s major cities jump significantly. In Edinburgh, the average rent in the city in Q1 2022 was over £1,200pcm for the first time on record, up 14% year-on-year. In Glasgow, the average rent is now nearing £1,000pcm, up 16% year-on-year. These strong rental increases, as well as the short time to let for properties coming to the market, reflect the strong levels of demand returning to the cities.

This said, the recovery of the core urban rental market has not been the only story in the Scottish PRS recently. Alongside the urban recovery, there has been the anticipated increase in suburban demand that was wider speculated about as the pandemic was in full effect. Some of the strongest rental price increases in the past year have been for larger 3 and 4 bed homes within the suburban locations. As residents test lifestyle changes, or have been challenged by values in the sales market, suburban renting has proved a popular choice, however, supply again remains low.

This combination of strong demand in both the urban and suburban markets, with low levels of supply, and a less straightforward landscape for small scale private landlord investment compared to 5 years ago, has created a supply challenge that needs answering.

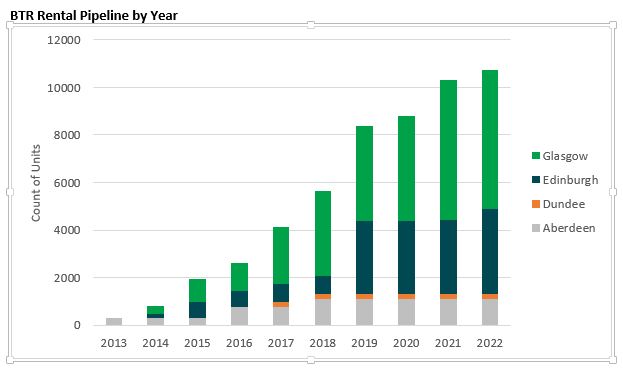

The much heralded, and still anticipated, potential solution for this shortfall is the emerging Build to Rent (BTR) sector in Scotland. While there are only a handful of operating schemes across Scotland, the pipeline of units progressing through the planning system has been growing year-on-year and now currently stands at over 11,500 units.

The growth of this sector has seen major UK and international operators entering the market in recent years. The interesting development in the Scottish market is the speed at which the sector is developing and diversifying, based on the learnings from more established markets. The initial weighting towards prime BTR developments, such as MODA’s prime McEwan scheme in Edinburgh’s Fountainbridge (which has the first phase now nearing full occupancy) has been quickly supplemented with other more mass appeal schemes, affordable rental schemes, as well as suburban and sharer based schemes. In Aberdeen, Dandara have launched The Point at Triplekirks which has co-living suites. Mid Market Rental offerings at Western Harbour have shown the strong demand for affordable rental options. Looking ahead, there is a clear interest in suburban BTR with major funders such as L&G active in these locations.

The appetite for units is developing in the market with major BTR providers such as PLATFORM_ now exceeding 1,000 planned units in Scotland, and the likes of Macquarie Group targeting the residential sector in the UK with its Goodstone Living brand. Other European based investors such as Heimstaden are also looking to expand their current Scottish holdings.

Having been involved in the Scottish PRS for well over 25 years, Rettie & Co. have been active in the past 5+ years in advising, delivering and growing the BTR sector in Scotland, which is flourishing in Scotland and delivering rental housing that is needed to meet the mixed tenure housing requirements across many of Scotland’s major economic centres.