As the first quarter of 2025 draws to a close, much of the global economic conversation has been shaped by the actions of the current resident of the Whitehouse. At the forefront is the growing focus on tariffs and their potential implications for global trade and economic stability. A pattern of frequent and unexpected policy shifts, combined with a lack of clarity surrounding the broader objectives of U.S. foreign policy, has created a heightened sense of uncertainty for international businesses.

Closer to home the UK economy is exhibiting some signs of recovery but faces several challenges. Gross Domestic Product (GDP) growth is tentatively picking up, particularly in the services sector, but remains relatively low compared to pre-pandemic levels. In addition, inflation has risen to the highest level seen in over a year at 3.5% which is higher than economists had expected and well above the 2% target figure for the Bank of England. The Bank of England has previously said it expects inflation to spike at 3.7% between July and September 2025 before dropping back to its 2% target.

April brought a fresh wave of cost pressures for UK households, with significant increases in energy and water bills, alongside moderate rises in food prices. Service costs rose by 5.4% year-on-year, largely driven by the rise in the National Minimum Wage and changes to National Insurance Contributions for employers.

These cost pressures are prompting renewed caution among economists. Some are now questioning whether the Bank of England might be cutting interest rates too quickly. Markets, which had previously anticipated two more rate cuts this year, have scaled back expectations, with most now predicting just one additional cut.

Despite these concerns, wage growth remains strong. Regular pay (excluding bonuses) rose by 5.6% over the past year, outpacing inflation. Even when bonuses are included, total earnings were up 5.5%. In real terms, accounting for inflation via the Consumer Prices Index including owner occupiers’ housing costs (CPIH), this translates to a 1.8% rise in regular pay and a 1.7% rise in total pay.

What does this mean for landlords?

While higher household costs may put pressure on tenants’ disposable income, strong wage growth offers a degree of reassurance. However, uncertainty around interest rate policy and economic stability means landlords should stay agile. Financing strategies, rent reviews, and property investment plans may all need to be reassessed in light of these developments.

Current UK property market

The UK property market showed impressive resilience throughout 2024, holding steady despite a series of headwinds, from political uncertainty and economic fluctuations to legislative changes, affordability pressures, and tax reforms. This stability has, for the most part, carried through into the first quarter of 2025.

However, recent developments, namely President Trump’s newly announced tariffs, have introduced renewed uncertainty.

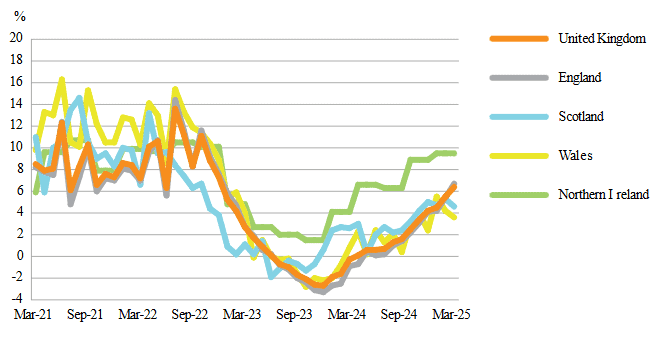

The Office of National Statistics (ONS) report that average UK house price increased by 6.4% (provisional estimate), to £271,000, in the 12 months to March 2025. This annual growth was up from 5.5% in the 12 months to February 2025. Annual inflation has been generally increasing since its low point of negative -2.7% in the 12 months to December 2023.

Average house prices increased to £296,000 (6.7%) in England, £208,000 (3.6%) in Wales, and £186,000 (4.6%) in Scotland, in the 12 months to March 2025.

Source: HM Land Registry, Registers of Scotland, Land and Property

Market activity is expected to remain subdued over the summer, as ongoing global economic uncertainty and weak buyer confidence continue to hold back demand. The recent uptick in inflation has added pressure on the Bank of England to delay further interest rate cuts, a move that’s likely to further dampen sentiment among potential buyers.

For landlords, this suggests continued tenant demand as more people delay purchasing and remain in the rental sector for longer. As always, staying up to date and understanding market trends can help landlords make informed decisions around pricing, investment, and portfolio strategy.

We also anticipate the continuation of the North-South divide in regional performance, with lower house price inflation in southern England compared to faster growth in other regions. This disparity reflects the relative affordability of housing across the country and the extent to which house prices have outpaced household incomes in specific areas.

There is undoubtedly real opportunity but those looking to invest will need to make sure they mitigate their risks by seeking professional advice and ensuring they deploy capital in a sensible strategic way.

The UK rental market

There is some positive news for tenants as signs of a cooling rental market are appearing across the UK, following years of chronic undersupply and excessive demand.

Rental demand has eased across all regions and nations of the UK.

At the time of writing the ONS report average UK monthly private rents increased by 7.4%, to £1,335 in the 12 months to April 2025 (provisional estimate); this annual growth rate is down from 7.7% in the 12 months to March 2025. Average rents increased to £1,390 (7.5%) in England, £795 (8.7%) in Wales, and £999 (5.1%) in Scotland, in the 12 months to April 2025.

Focus on the Scottish rental market

In some unexpected news the Scottish Government announced that all rent caps have ended. Rent disputes will now be assessed based on ‘open market’ values. This marks a major shift for landlords, allowing rents on sitting tenancies to return to market levels for the first time in over two years. It will be interesting to see how this impacts the market in the coming months.

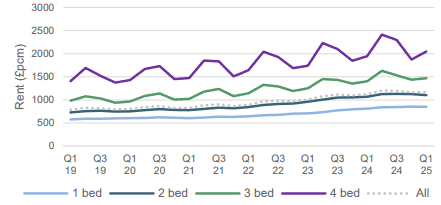

Citylets report that average rental price growth in Scotland for new tenancies stands at 4.4% year on year. The average rent in Scotland for a new tenancy is currently £1,172 PM.

Average rent (PCM) by number of bedrooms

Source Citylets

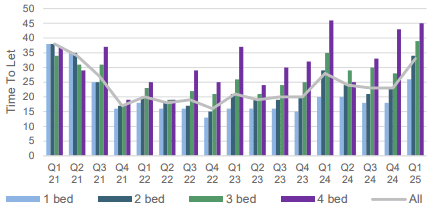

Competition amongst tenants for properties has cooled and we are not seeing quite the same frenzied activity levels in the market as was experienced post the pandemic.

Average Time to Let (TTL) by Numbers of Bedrooms

Source Citylets

The Scottish rental market is undergoing a recalibration, echoing broader trends seen across the UK. A gradual narrowing of the supply-demand imbalance is beginning to ease the pace of rental inflation. While growth in rents remains in positive territory across most regions, the rate of increase is clearly slowing as more stock returns to the market.

The recent removal of rent controls marks a significant policy shift, yet tight market conditions persist. Affordability remains a key concern for tenants, tempering the potential for aggressive rent hikes. We are seeing the market move towards a more balanced, pre-pandemic dynamic one defined by more stable pricing and sustainable demand.

While the fundamentals remain strong, it’s increasingly important to factor in broader economic headwinds, such as inflation, interest rates, and regional employment trends, when assessing long-term yield prospects.

Property as an asset class

In periods of economic uncertainty, savvy investors know the importance of diversification. Investors will seek refuge in assets that can weather inflationary storms in a world of economic uncertainties. Inflation erodes the actual value of money, meaning that over time, the same amount of money can buy fewer goods and services. This can adversely affect investment returns, especially those with fixed returns like bonds and savings accounts. Therefore, investors often seek inflation hedges utilising assets that tend to appreciate as inflation rises.

Investing in buy-to-let property offers a dual benefit: the potential for long-term capital growth and a steady rental income stream. Real estate can play a crucial role in inflation hedging as it provides investors with a reliable and effective strategy to protect their wealth from the impact of rising prices. As inflation erodes the value of traditional assets, real estate’s tangible nature and potential for value appreciation make it a sought-after investment. Unlike more volatile investments, housing tends to hold its value better during downturns driven by consistent demand, especially in thriving urban areas.

Moreover, residential property isn’t directly tied to stock market movements, making it an effective way to spread risk across an investment portfolio. For landlords and property investors, this means greater stability and control, even when markets are unpredictable.

In short, bricks and mortar continue to be a cornerstone of smart, diversified investment especially when the future feels uncertain.

It can be worth contacting an asset management company as they understand property as an investment class and will be focussed on ensuring clients benefit from the best possible returns from their investments, whilst ensuring their regulatory and legal responsibilities are met and their risks are minimised. Their expertise can guide clients in capitalising on opportunities within a well-balanced, strategic investment plan. They can share advice on how to practice prudent wealth management and build a diversified portfolio of assets in which property plays a crucial role offering strong returns over time, with opportunity for capital growth and a regular source of income.