To those involved in the explosive growth of the Residential Investment Sector in the UK, with the (long) overdue entry to the market of institutional investment, it has become increasingly clear there are opportunities for new and innovative forms of residential rental accommodation. These concepts can maximise affordability for tenants, while retaining quality of operation and returns to funding partners. The proportion of the UK population that is, and projected to be, seeking residential rental accommodation in the coming years is increasing rapidly, creating an opportunity for new investment allied to quality operators and developers.

Demographic trends are affecting the prime renting population in their twenties and thirties. Marriage and family formation have been delayed, while educational attainment among this age bracket is at record highs. Student loan debt is also at record highs, along with record low savings accounts. Coupled with this, the trend towards defined contribution pension requirements will put greater financial strain on private renters, as the lack of purpose built and professionally managed rental accommodation becomes apparent.

Collective living is a natural solution to this housing environment where tenants can share units and amenities in a cohesive community assisted by a skilled operator. Location, lifestyle, community and affordability are all maximised to provide value for the tenant. In this environment, operators provide a product that better reflects the price range and types of living situations people are looking for when they move into an urban area.

Value for money is at the heart of collective living, via which tenants can pay less rent by trading private space for more and better shared communal space. Typically, collective living providers include additional services and perks, including fully furnished units, all utilities included, hosted community events and even housekeeping, which in the aggregate represent as much as a 20% discount to living alone. For the operator, this opens new avenues to differentiate their product, taps into a large renter base not currently served by top-end luxury product, and maximises revenue on a per square foot basis with a diversification of income sources.

Investor demand and financial aspirations

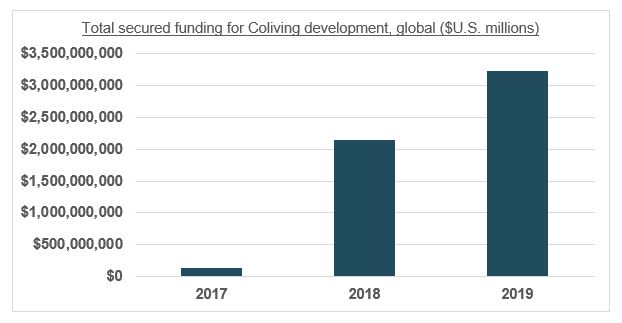

Rising prices in the world’s major cities have seen dorm-like collective living accommodation become more commonplace well into adulthood for working professionals moving to urban areas, and investors are taking note. As the below table demonstrates, global funding in the collective living space is increasing rapidly with numerous operators and developers entering the market.

Although collective living is deemed most suitable for young professionals, operators target a wide demographic. Ideally, tenants are between the ages of 25 and 50 and earn in the region of £35,000 to £65,000 a year. This group that collective living targets desire the affordability the asset class delivers above other benefits located in economically prosperous gateway, but unaffordable, city centre locations. This wide customer base provides a more secure cashflow with operational collective living schemes functioning at close to 100% occupancy.

For any real estate investment product to achieve market penetration, the institutional funders prevalent in the Residential Investment Sector will be required. These capital sources have a number of prerequisites that must be met before a funding allocation can be decided. Whilst any institution may have its own specific return requirements, the investment prerequisites for collective living as a concept can be said to have now been met:

- Demand for collective living has been proven

Demand is evident by the success of current examples of existing collective living schemes running at near 100% occupancy in typical market conditions. UK and other European cities are becoming denser. In Europe, by 2029 there will be 13 million more people living in cities than a decade previous, accounting for 77% of total population, up from 62% 50 years ago with record numbers of under 35s now in the rental market to whom this product will be attractive.

- Lack of supply

As a new concept, well managed and properly designed schemes are currently rare in the UK, particularly outside of London and the south-east of England. Therefore, there will be excess demand for this asset type going forward in dense urban locations across the UK.

- Proof of concept

There is now an example of a collective living asset that has been acquired, developed, operated and a successful exit achieved. The Collective, a ground up developer and operator of collective living accommodation, completed a management buyout of their Singaporean co-owners 75% stake in the Old Oak Co-Living scheme in north-west London, in Q4 2018. While an original deal to sell the entire development to Red Door Ventures fell through in mid-2018, lenders Deutsche Bank and Catalina RE were willing to provide substantial debt for a large-scale collective living development. The debt was also provided at a valuation much higher than the initial asking price of $100m, with a yield of c. 4.00% implied.

With the collapse of The Collective in late 2021 following the pandemic, wider questions about viability, particularly in the wake of the pandemic have been posed. It is important to remember that sites outside the UK are held in separate entities and are not involved in the administration. Further, its two live sites in the UK – at Canary Wharf and Old Oak – remain operational after the administrators reached an agreement with key stakeholders, signalling confidence in the fundamentals the collective living business model seeks to address. This has been further confirmed by Common (an American collective living operator) planning a UK-led European expansion of 3,000 units by 2023.

The Scottish context

This confidence in the concept is reflected in the inroads collective living is slowly making into Scottish markets. Examples include The Point in Aberdeen operated by Dandara Living which offers co-living suites with dedicated amenity and the option of inclusive utilities. Watkin Jones pioneering scheme, on the site of the former Portcullis House, adjacent to Charing Cross Station in Glasgow will be an excellent test-case for the concept. Mixing 279, investor friendly, Build to Rent units across 33 storeys a further 406 co-living suites will operate to the south of the site.

The key to success with this new concept will be high quality business planning with a well-researched and curated offering, alongside a high quality and competent residential operating partner. There is currently no single answer to specific questions of design, ratios of amenity to apartment space and operations. Well thought through schemes will be critical in providing affordable accommodation meet demographic needs while ensuring funding partner return requirements are met.

For more information or advice, please contact us.