The need for new homes

Homes for Scotland has estimated the need for 25,000 new homes each year to meet current housing demand. Construction on this scale has not been seen since 2007 in the build-up to the global financial crisis, with the 5-year average currently at c. 19,500.

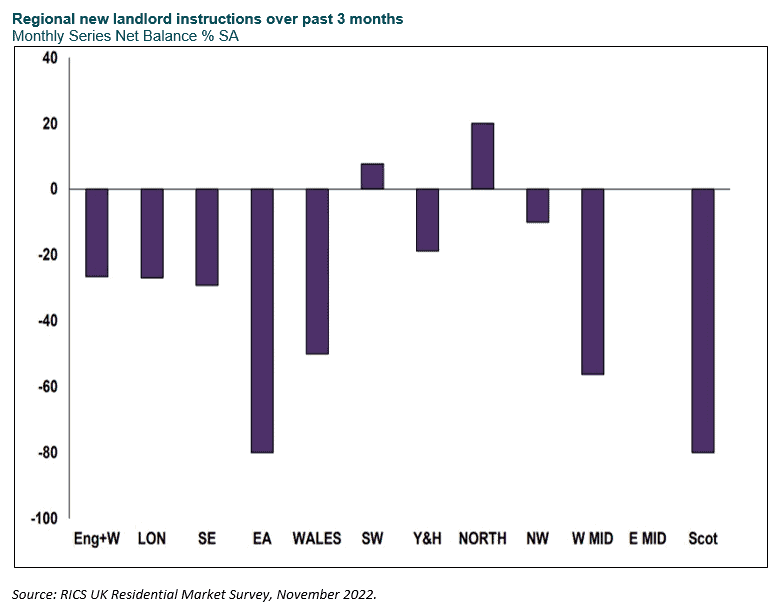

During the cost of living crisis, interest rates have increased, with the Bank of England base rate now at 3.5%, up from 0.1% in December 2021. This increase in interest rates, coupled with the surprise rent freeze introduced by the Scottish Government in September 2022, may continue to force small-scale private landlords out of the sector. The RICS national survey results show a significant reported decrease in new landlord instructions across the UK, particularly in Scotland. As small-scale private landlords exit the sector, the undersupply of homes may provide an opportunity for institutional investors to meet this housing demand.

Other indicators also point to a significant undersupply of available rental properties. As per Citylets’ latest quarterly report, Q3 2022 average time to let across Scotland is now at 19 days, an 8 day decrease on the year prior. In Edinburgh this figure is lower at 15 days, half the number it was in Q3 2021, and in Glasgow it is lower still at 13 days.

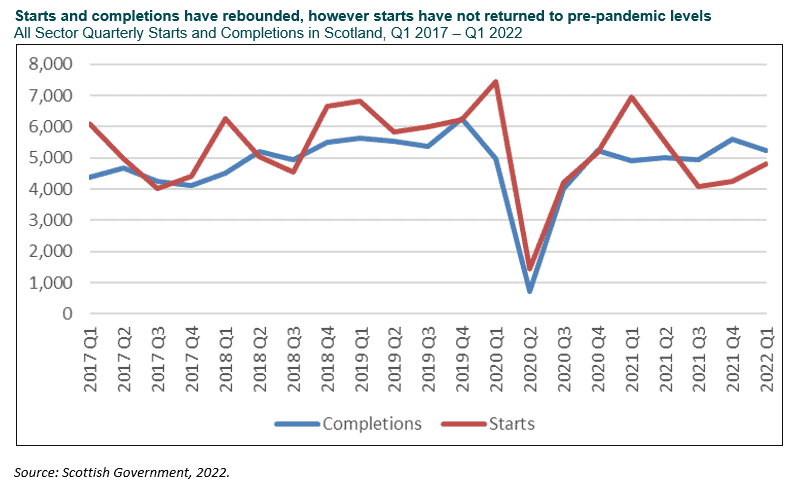

As is well documented, private sector completions of new housing has outpaced the public sector every year since 1978. In 2021, the private sector accounted for 70% of all new dwelling completions. Starts and completions fell dramatically during Q2 2020 due to Covid-19 restrictions, however, while they have since rebounded to more normal levels, starts have not fully recovered to the levels seen pre-pandemic.

The latest data released on starts and completions provides figures up to and including Q1 2022. Since then, the housing market has changed dramatically, with increased interest rates, higher construction costs, and the introduction of a temporary rent freeze until 31st March 2023. When the next set of data is released, it will be interesting to see what impact these factors have had on starts across Scotland since Q1 2022.

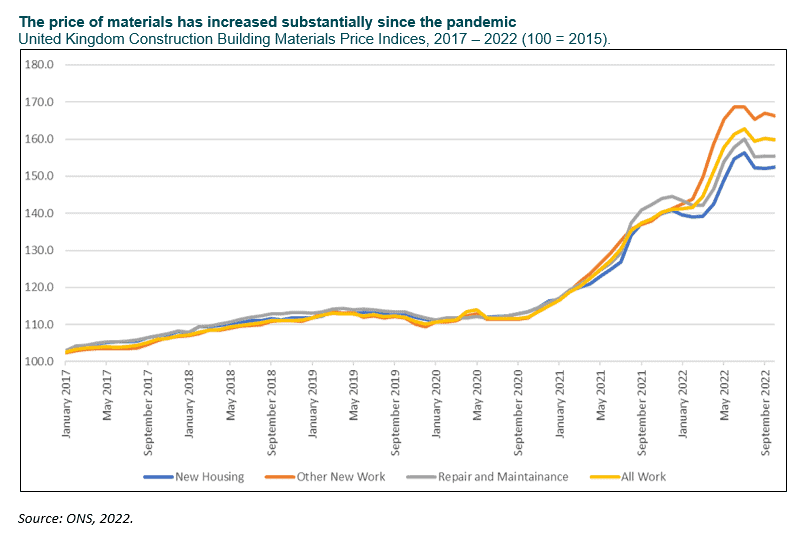

In the 24 months between October 2020 and October 2022, the UK Construction Material Price Index for New Homes increased in all but four of those months. The index currently stands at 152.4 in the latest figure for October 2022, an increase of 14 from October 2021. While growth in the index appears to have stalled since the highs seen in July, it remains to be seen whether this latest levelling off of material costs is temporary or permanent.

Demand for rental properties

The demand for affordable housing in Edinburgh remains strong, in particular for 1-bedroom properties. With the cost of living crisis and increased interest rates pushing would-be first-time buyers out of the sales market, theoretically, we should expect to see increased demand for rental properties.

As you would expect with constrained supply and increasing demand, price increases will follow. Despite the rent freeze introduced in September, average rents have risen 8.3% in the year Q3 2021 to Q3 2022. Edinburgh and Glasgow saw higher growth of 14.7% and 12.6% respectively. The highest rental growth, both nationally and in Edinburgh and Glasgow, was for 2-bedroom properties.

The uncertainty around rent controls by the Scottish Government has no doubt exacerbated the situation, particularly in allowing BTR and institutionally funded homes to build at scale and pace.

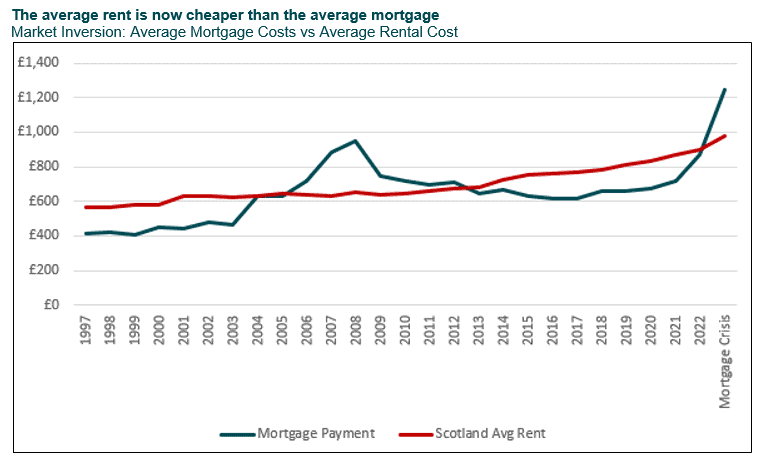

Regardless of the increase in average rents, for the first time since 2012, the average rental cost in Scotland is now cheaper than the cost of the average mortgage. Tenants who were thinking about making the move from renting to property ownership may decide to remain in their current rented property until mortgage products become more affordable.

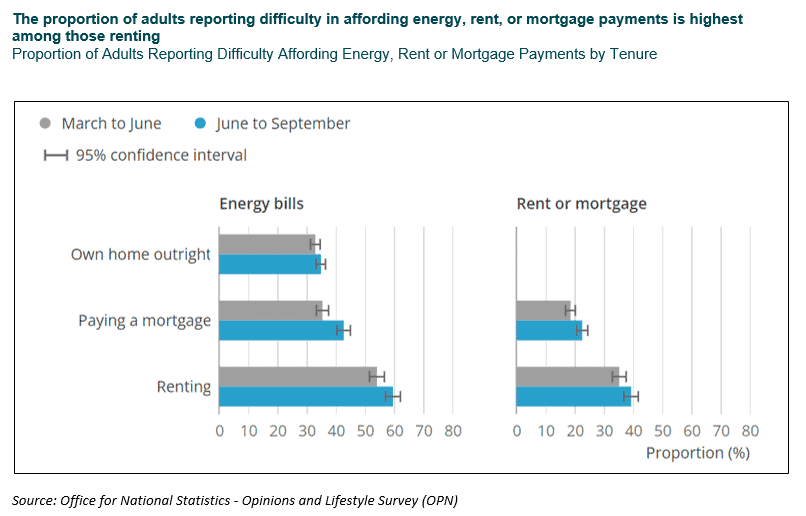

The ONS Opinions and Lifestyle Survey provides an insight into how people in the UK feel they are coping with their living costs. As would be expected, those on lower incomes of less than £20,000 per year are particularly struggling during the cost of living crisis, with around half of those surveyed stating that they found it difficult to afford their energy bills. The latest results also show that approximately four in ten renters surveyed between June and September found it difficult to afford their rent payments. For those with a mortgage, this figure was lower, with 23% stating they found it difficult to afford their mortgage payments. When compared with the previous survey of March to June 2022, the results show that across all tenures adults are finding it increasingly more difficult to afford their energy, rent and mortgage payments, further strengthening the need for more affordable housing provision.

Affordable BTR

Overall, the current market factors provide an opportunity for institutional investors to meet current housing demand in a time of constrained supply. Amid the cost of living crisis, the mortgage crisis and the housing crisis, the case for affordable housing provision is clear. If the Scottish Government wants to address some of these issues, BTR at scale will be crucial. However, they will need to reassure institutional investors looking to fund these developments with some certainty in what if any controls will be facing post March 2023.

For more information or advice, please contact us.