In Light of the Diligence Against Earnings (Variation) (Scotland) Regulations 2024

Rent arrears remain a common reason landlords seek to terminate Private Rented Sector tenancies. In such cases, when seeking an Eviction Order from the First-tier Tribunal, landlords will often also make an application for a Payment Order to recover the debt.

What do you do when a Payment Order is granted?

Obtaining a Payment Order doesn’t guarantee you will recover all, or even part, of what is owed by the tenant. Once a Payment Order is issued, the Tribunal process ends and the landlord requires to instruct formal diligence to attempt to recover sums due.

Earnings arrestment’s can be an effective method where a debtor (i.e. tenant) is employed, as it places an onus on the debtor’s employer to make deductions from their wages to gradually repay the debt. However, recent changes to the rules have increased protections for low earners.

What has changed?

On 6th April 2025, the Diligence against Earnings (Variation) (Scotland) Regulations 2024 came into force. The Regulations increase the protected minimum amount below which deductions cannot be taken under an earnings arrestment.

The monthly protected amount is now £750 (net pay), an increase from £655.83 in 2023. This means if your debtor takes home less than £750 per month, you will receive no payments under the earnings arrestment. Whereas if your debtor takes home more than £750 you can expect to recover a certain amount towards the debt.

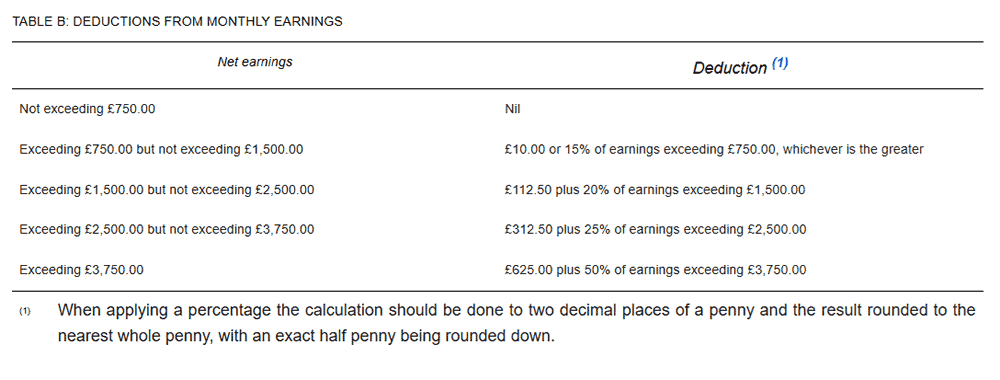

The Regulations also adjust the table bandings which determine how much can be deducted from earnings above the protected amount. Ongoing deductions under existing arrestment’s will also be calculated using these bandings.

It is important to note the changes introduced by the Regulations do not affect the total debt due to be repaid. However, changes as to how deductions are calculated will likely increase the period of time before the debt is fully cleared, especially for lower earning debtors.

For more information or advice contact: prs@tcyoung.co.uk