In the last quarter of 2022, pressures on property supply in the private rented sector continued driving growth in average rents in Scotland for new tenancies at an unprecedented rate amid widespread industry condemnation of the new legislation and general asymmetry of approach relative to the social rented sector.

The introduction of the Cost of Living (Tenant Protection) (Scotland) Bill freezing rents for pre-existing tenancies, combined with the disastrous UK mini-budget, have been unsettling for providers of private rented accommodation posing real risk of destabilising the viability of their provision at a time of chronic undersupply.

Whilst near or medium term property costs have risen substantively through spiking mortgage rates, landlords’ ability to mitigate this financial burden has been restricted, with rent increases prohibited until 31st March 2023 and a cap on private rents set at 3% (6% under prescribed grounds) thereafter up to 30th September 2023, subject to Scottish Parliament’s approval.

With the social rented sector exempted from rent caps, private landlords will be unsurprisingly feeling singled out despite industry consensus that they could have comfortably met the provisos and parameters for this exemption if given the opportunity, especially given in-tenancy rent rises are reportedly much more the exception than the norm.

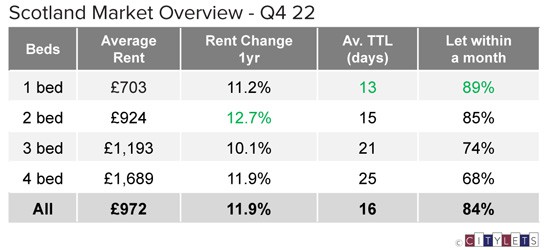

Q4 2022 saw low stocks, relative to demand, sending initial rents in Scotland up 11.9% year on year to average £972 per month, the steepest rise on record in 16 years of Citylets’ reporting. The average property took 16 days to let in the last quarter of 2022, highlighting the fact that rental property remains in high demand across the country.

Commenting on the Scottish lettings market, Adrian Sangster of Aberdein Considine said: “The chronic shortage of PRS properties available continues, whilst demand seems to be ever increasing. As a result, rents throughout Scotland continue to increase along with the stress levels of many people desperate to find a home. The political football that the Scottish PRS has become, was pumped up, kicked around and burst by politicians. It’s now landlords and tenants who are suffering for their failures.”

Karen Turner of Rettie & Co added: “We are nationally facing a housing crisis and this, along with the Cost of Living (Tenant Protection) (Scotland) Bill, is a concern as to where the properties are going to come from to meet demand. We require to see positive solutions to aid more housing across all sectors.”

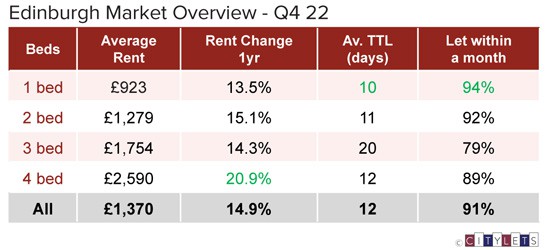

The Edinburgh lettings market recorded a double digit annual growth of 14.9%, with the average property renting at £1,370. Time to lets remained almost unchanged compared to the same time in 2021, now at 12 days.

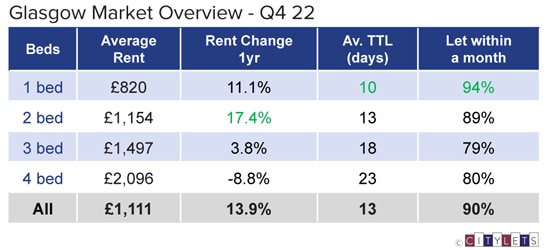

The competition for property to let in Glasgow over Q4 2022 was also fierce, with properties taking 13 days to let on average. Rents in Glasgow continued to push upwards to an average of £1,111, up 13.9% year on year.

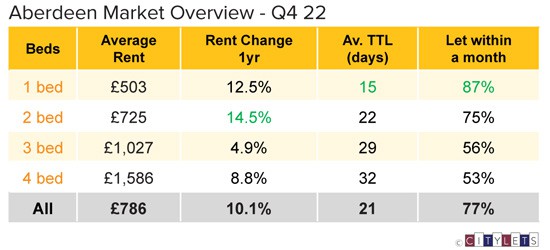

Aberdeen recorded annual growth at 10.1%, with the average property for rent in the Granite city commanding £786 per month and time to lets significantly reduced to 21 days.