Brexit has ushered in a period of significant change for the United Kingdom, including Scotland. Among many other sectors, it has affected the rental market in various ways, some anticipated, others unforeseen. This blog aims to unravel some of the critical impacts Brexit has had on Scotland’s rental market.

Challenges

To start, the uncertainty surrounding Brexit led to a slowdown in the property market across the UK. This was, in part, due to reduced inward migration, especially from EU countries. Scotland, known for its vibrant cities and idyllic countryside, saw a dip in the demand for rental properties as a direct result of this decreased migration. Many Europeans who might have otherwise sought work and rented homes in Scotland, were deterred due to the uncertainties and complexities surrounding immigration rules post-Brexit.

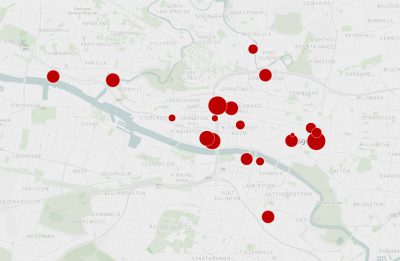

Secondly, the building and construction industry, pivotal to the growth of the rental market, was negatively impacted by Brexit. It faced shortages of materials and skilled labour due to both reduced migration and new trade barriers, leading to reduced capacity. With less new housing being built, pressure has been put on the available rental properties, especially in desirable areas such as Edinburgh and Glasgow. This, combined with the existing issue of affordable housing shortage, has led to increased rental prices in some areas.

Opportunities

Despite the challenges, Brexit has also presented opportunities in the Scottish rental market. For instance, uncertainty in the sales market has prompted some people to continue renting rather than purchasing property. This has, to some extent, sustained demand in the rental sector.

Furthermore, the weakened pound has made the UK, and by extension Scottish properties, more appealing to overseas investors. As a result, there has been a surge in buy-to-let landlords, particularly from outside the EU, investing in the Scottish rental market. This trend has led to a slight growth in available rental properties and diversified the market.

Full impact

However, it’s worth mentioning that the full impact of Brexit on Scotland’s rental market is still unfolding. For instance, the introduction of the points-based immigration system in 2021 has the potential to limit low-skilled migration further. This change may particularly affect demand in areas with a high proportion of low-wage earners and potentially decrease rental demand in these areas.

Additionally, the UK government’s decision to replace EU funding programs with the UK Shared Prosperity Fund could affect the social housing sector. The EU had been a significant contributor to social housing initiatives in Scotland, and it remains to be seen if the new fund will adequately cover these costs. If not, the pressure on affordable rental housing could increase even more.

In conclusion, the full impact of Brexit on Scotland’s rental market will likely only become apparent over the next few years. Changes to migration, uncertainty in the broader housing market, shifts in property investment patterns and potential funding changes for social housing are all influencing the rental landscape in different ways.

While these changes may present challenges for landlords, tenants and property professionals alike, they also provide opportunities for innovation, policy reform and new ways of thinking about housing in Scotland. As we navigate these uncharted waters, adaptability, preparation and an understanding of this ever-changing environment will be vital to thriving in Scotland’s post-Brexit rental market.