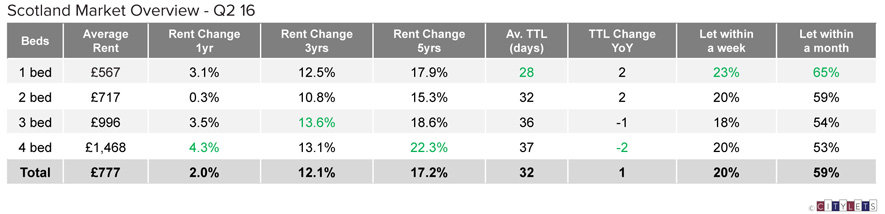

The trends observed in The latest Citylets Quarterly Report to Q2 2016 have been a picture of almost unparalleled consistency amidst a world of uncertainty not seen since the financial crisis of 2008.

Average rents at National level and within the main city markets of Edinburgh, Glasgow and Aberdeen are following seemingly set growth trends of c2%, 6%, 5% and -20% respectively.

With Brexit fresh out of the oven, it will be interesting to see if this now continues. On any view it is too early to tell which influences on both the supply and demand side of the market will become dominant, in turn determining the balance and hence rents in local markets.

For Agents, meantime, it seems very much business as usual though the recent trading suspension in some major property funds will not have gone unnoticed.

“The referendum result was a great shock but for the moment it’s a case of ‘carry on as before’ for the rental market. There may be unknown consequences ahead but the one certain thing is that the current demand for rented accommodation will not ease up.”

(David Alexander of DJ Alexanders)

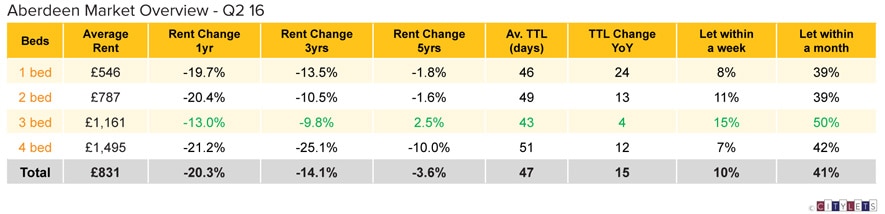

Aberdeen Rental Market

Average rents in Aberdeen again recorded negative annual growth at around 20% suggesting that the rate of decline has now peaked and an improved annualised picture in subsequent quarters may lie ahead. The average property in Aberdeen now rents at £831 per month taking 47 days to let, around 2 weeks longer than the same period last year. It is likely that average rents in Aberdeen will now reach and possibly breach the national average. However, 41% of all properties lease within 1 month reflecting plenty of life in the market as it goes through its transition period.

“2016 continues to be a year of readjustment for the leasing market in Aberdeen as a direct result of the oil price drop. Rental levels are lower across the board, but they still compare well to a national average and there is optimism about increased activity in the area through 2017.”

(Sarah Harley of Margaret Duffus)

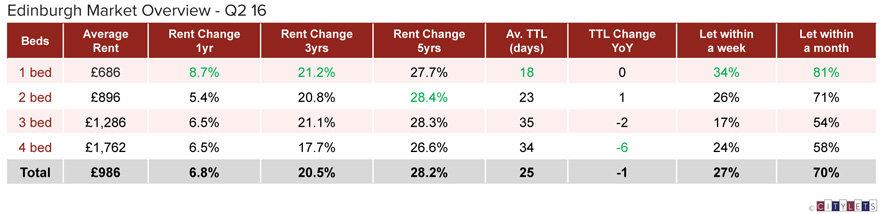

Edinburgh Rental Market

The Edinburgh market edges up ever closer to the £1000 average mark and at the same rate recorded over the last few quarters, around 6%. The average rental in the capital is now £986 per month with 70% of properties let within a month. The ever popular one bed properties rose fastest at 8.7% YOY to stand at £686 on average and with 34% let within 1 week.

“Whilst there is no let up with rents increasing in Edinburgh, supply is now a major problem. There is no doubt that we need to be building more properties but following the Brexit vote…….it would be a prudent stance to acknowledge that this may impact on both our Landlords and Tenants.”

(Grant Denholm of Littlejohns Ltd)

Glasgow Rental Market

Glasgow also continues its steady climb at 5% YOY growth to sit at £719 on average as at Q2 2016. The market is moving quickly with an average Time to Let of 26 days. Almost 25% of properties are off the market within a week and two thirds take less than a month. For investors, the market is proving stable with 5% growth on average over the last 3 years and 4% over the last 5.

“We have seen sustained growth yet again in the PRS with rents on the increase in popular locations such as the affluent city centre, west end and Southside markets and TTL’s reducing for quality properties.”

(Colin MacMillan of Glasgow Property Letting)

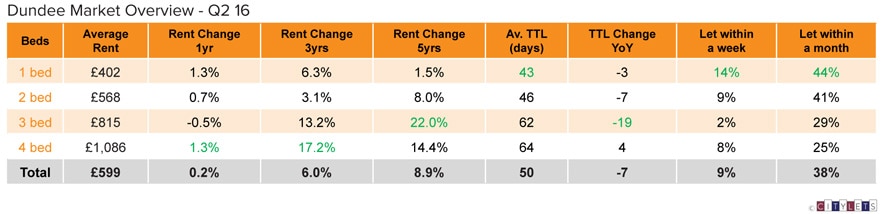

Elsewhere, Dundee is almost unchanged on Q2 2015 with average rents at £599, down from £620 last quarter. West Lothian is experiencing strong growth over the last 12 months, up 6.4% to average £652, with all property types letting more quickly than a year ago. Larger 3 bed properties show the biggest gains from a 1,3 and 5 year perspective reflecting an increased demand for family homes in the PRS.

“The second quarter of 2016 has been a busy period and no problems have been experienced in achieving the rentals being sought. This has been the case “across the board” i.e. all types of properties, indicating confidence in the rental market in Dundee area at the present time.”

(Robert Murray of Lickley Proctor Lettings)

The full Citylets Quarterly Report on Scotland’s rental prices can be found at https://www.citylets.co.uk/research/reports/pdf/Citylets-Quarterly-Report-Q2-16.pdf

The Citylets Quarterly Reports are widely regarded as the most authoritative barometer of the Scottish PRS with expertise built over 10 years of publications. For enquiries, please contact us.