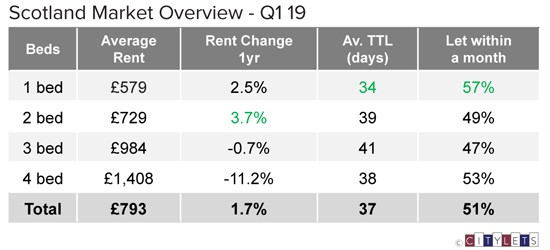

Rents in Scotland’s private rented sector (PRS) continued to edge upwards in the first quarter of the year despite the political landscape which has impacted markets in other sectors. The average property to rent in Scotland rose 1.7% to stand at £793 per month. 1 and 2 bed properties charted a familiar course both recording positive annual growth however mixed signals at the local level were evident, especially in Scotland’s central belt. Overall the market operated at the same speed as Q1 2018 with the average property taking 37 days to let.

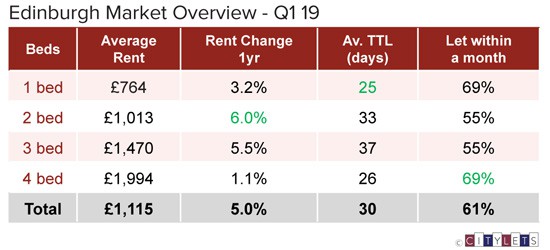

Edinburgh

Property to rent in Edinburgh rose to a new record high of £1115 per month against a backdrop of lengthening Time to Lets (TTLs), consistent with anecdotal evidence from local agents of tenants shopping around and taking advantage of the increased choice in the market. Q1 2019 saw properties take 30 days to rent on average, 3 days longer than the previous year. The rate of growth at 5% will once again cheer landlords and concern tenants however this is a lower rate of growth than previous quarters with longer TTLs hinting at a possibly softening market after more than 9 years of annual growth each quarter.

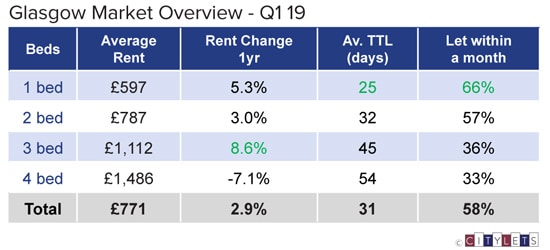

Glasgow

Tenants in Glasgow have also been reportedly shopping around before committing to a rental property. Nonetheless, the figures for Scotland’s largest city remain stable with rents up a modest 2.9% to average £771 per month and TTL unchanged on last year at 31 days. 3 bed properties rose a significant 8.6% on last year whereas 4 bed properties fell, down 7.1%. Volatility in the data for larger properties however is not uncommon given the lower volumes reported each quarter. Glasgow’s main 1 and 2 bed property markets continued to post strong growth at 5.3% and 3% YOY. 58% of all Glasgow properties are currently let within 1 month.

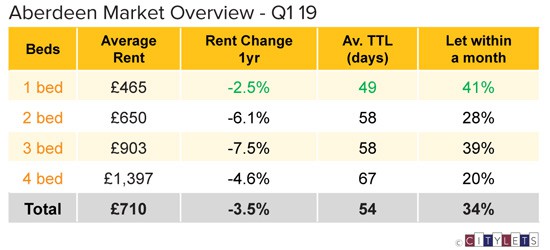

Aberdeen

Falls in rent were reported for all property types in Aberdeen in Q1 2019 however at minus 3.5% growth YOY, the rate of decline continues to ease. With re-let times continuing to reduce it is fair to view the figures for Q1 2019 as positive overall for landlords in the granite city. 1 bed properties fared best across key metrics of growth (minus 2.5%), TTL (49 days) and % let within 1 month (41%). The average property to lease in Aberdeen now costs £710 per month and takes 54 days to let, 4 days faster than last year.

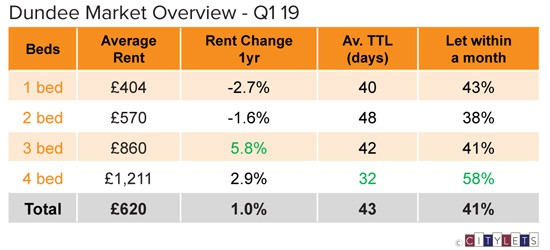

Dundee

Dundee starts 2019 where it left off as rents continue to move upwards, albeit at a modest 1% YOY as at Q1 2019. The average property to rent in Dundee stands at £620 per month and takes around a month and a half to let at 43 days. As with other cities, the market data for Dundee was conflicting in part recording decreased rents for mainstream 1 and 2 bed markets but improved re-let periods. Rents for 3 and 4 bed properties continued to climb YOY.

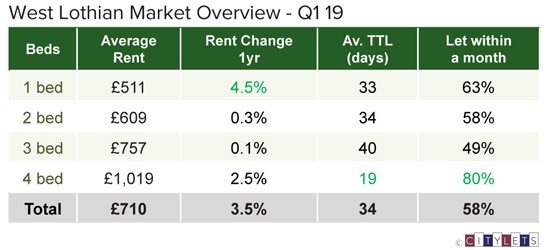

West Lothian

Property to rent in West Lothian continues to enjoy good demand seeing averages rise once again, up 3.5% to £710 per month – same as the current average for Aberdeen. The signs for this popular commuter belt region looks positive for Landlords with the time to secure tenants also notably falling to just over 1 month at 34 days.

The full Citylets Quarterly Report on Scotland’s rental prices can be found at:

https://www.citylets.co.uk/research/reports/property-rental-report-scotland-2019-q1/

A report PDF is available at:

https://www.citylets.co.uk/research/reports/pdf/Citylets-Quarterly-Report-Q1-2019.pdf

The Citylets Quarterly Report is widely regarded as the most authoritative barometer of the Scottish PRS with expertise built up over 13 years of publication. For enquiries, please contact us.